Groceries with Warren

Previously I wrote that I didn’t agree with prevailing Wall Street views that saw the Delta-variant threat as insignificant. For a while it did seem markets were in agreement with said analysts - the VIX dropped below 16 just a week ago! I honestly thought I could be left holding the bag here with my long VIX positions. But try as I might, I could not come up with a good excuse for the VIX trading at 16 given covid cases are on an exponential trajectory.

So I held on and yesterday (with much relief!) I unloaded my VIX futures at 24 (here my tweet chronicle). I will be on the lookout for a new entry opportunity as the Delta wave progresses.

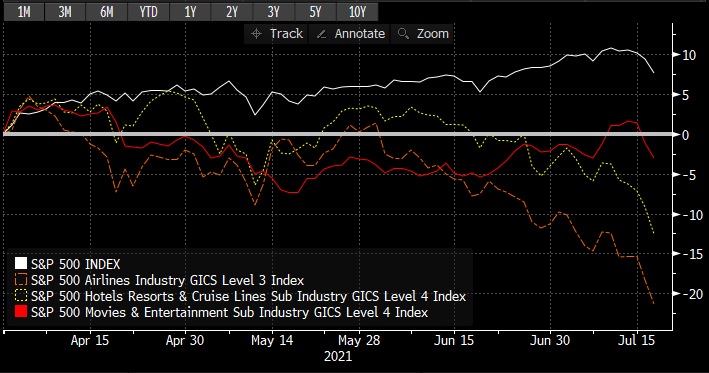

Just as markets are looking bearish much before Delta peaks, they may price in a recovery much before the wave subsides. The overall losses in the market are barely 2-3% off last week’s peak, not even close to correction status. But if you look under the hood, there is considerable divergence:

Covid-sensitive sectors are looking even more attractively discounted than the last time I mentioned it. Most of you know Warren Buffett’s most-quoted quote, attributed to his mentor:

“We advised the readers to buy their stocks as they bought their groceries, not as they bought their perfume.”

- Benjamin Graham, the Intelligent Investor

Is it time to buy groceries? I agree that there is a renewed opportunity now to participate in the recovery trade. But I would still tread carefully. On the one hand Delta is still just getting started and on the other one doesn’t know how long the opportunity will last.

I can see it as being reasonable to start buying, in covid-sensitive sectors, provided one has a 1-2 year horizon at the minimum and is willing to stomach volatility. Prepare to be “buffett”-ed around. That is the down payment for later rewards.

It is also worth drilling down into just what risk the market may see in the Delta variant.

The key is mobility changes in the urban middle or upper class population. Though this group is heavily vaccinated, their risk aversion is high and risk aversion can be more important than vaccination status. E.g. see this (unscientific) twitter poll:

People who are vaccinated and therefore least at risk from Delta are paradoxically the most likely to curtail their activities. The unvaccinated don’t really care that much - else they would be vaccinated, wouldn’t they?

This brings us to GDP. The urban middle and upper classes are veritable stores of GDP contribution. They hardly overlap with the unvaccinated population which has more of these attributes:

Rural or semi-rural

Low income / education

Below 30 years old

Ergo, the unvaccinated contribute less to economic activity and don’t intend to reduce mobility anyway. They are not part of the economic issue here.

Delta fears in equity markets are expectations of lower-than-expected mobility among people who are urban, well-off and vaccinated. It makes sense therefore to closely monitor activity indicators such as urban mobility trends, subway ridership etc. You can bet the markets are watching the same.

It is possible that at some point vaccinated people will re-evaluate their risk preferences and decide that they need not worry about Delta. But it will take time for them to be convinced and when it does, mobility data may reflect it.

There remains a non-trivial question: how long will covid-19 continue to hamper economic activity?

My best guess is that the upcoming Delta wave could be the last consequential one in the US. After Delta has slammed through our vast unvaccinated population there may be few left who were neither vaccinated nor infected. And quite a few will have seen both the needle and the disease1.

After that SARS-CoV-2 may join the ranks of other common-cold coronaviruses. Public health officials will still worry about it but markets won’t.

We are not there yet.

The mRNA vaccines are probably about 80% effective against symptomatic Delta infections. That still implies millions of fully vaccinated people will experience covid-19.